Regression Penalties in DLT¶

This notebook continues to discuss regression problems with DLT and covers various penalties:

fixed-ridgeauto-ridgelasso

Generally speaking, regression coefficients are more robust under full Bayesian sampling and estimation. The default setting estimator='stan-mcmc' will be used in this tutorial. Besides, a fixed and small smoothing parameters are used such as level_sm_input=0.01 and slope_sm_input=0.01 to facilitate high dimensional regression.

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

import orbit

from orbit.utils.dataset import load_iclaims

from orbit.models import DLT

from orbit.diagnostics.plot import plot_predicted_data

from orbit.constants.palette import OrbitPalette

[2]:

print(orbit.__version__)

1.1.3

Regression on Simulated Dataset¶

A simulated dataset is used to demonstrate sparse regression.

[3]:

import pandas as pd

from orbit.utils.simulation import make_trend, make_regression

from orbit.diagnostics.metrics import mse

A few utilities from the package is used to generate simulated data. For details, please refer to the API doc. In brief, the process generates observations \(y\) such that

\[y_t = l_t + \sum_p^{P} \beta_p x_{t, p}\]

\[\text{ for } t = 1,2, \cdots , T\]

where

Regular Regression¶

To begin with, the setting \(P=10\) and \(T=100\) is used.

[4]:

NUM_OF_REGRESSORS = 10

SERIES_LEN = 50

SEED = 20210101

# sample some coefficients

COEFS = np.random.default_rng(SEED).uniform(-1, 1, NUM_OF_REGRESSORS)

trend = make_trend(SERIES_LEN, rw_loc=0.01, rw_scale=0.1)

x, regression, coefs = make_regression(series_len=SERIES_LEN, coefs=COEFS)

print(regression.shape, x.shape)

(50,) (50, 10)

[5]:

# combine trend and the regression

y = trend + regression

[6]:

x_cols = [f"x{x}" for x in range(1, NUM_OF_REGRESSORS + 1)]

response_col = "y"

dt_col = "date"

obs_matrix = np.concatenate([y.reshape(-1, 1), x], axis=1)

# make a data frame for orbit inputs

df = pd.DataFrame(obs_matrix, columns=[response_col] + x_cols)

# make some dummy date stamp

dt = pd.date_range(start='2016-01-04', periods=SERIES_LEN, freq="1W")

df['date'] = dt

df.shape

[6]:

(50, 12)

Here is a peek on the coefficients.

[7]:

coefs

[7]:

array([ 0.38372743, -0.21084054, 0.5404565 , -0.21864409, 0.85529298,

-0.83838077, -0.54550632, 0.80367924, -0.74643654, -0.26626975])

By default, regression_penalty is set as fixed-ridge i.e.

with a default \(\mu_j = 0\) and \(\sigma_j = 1\)

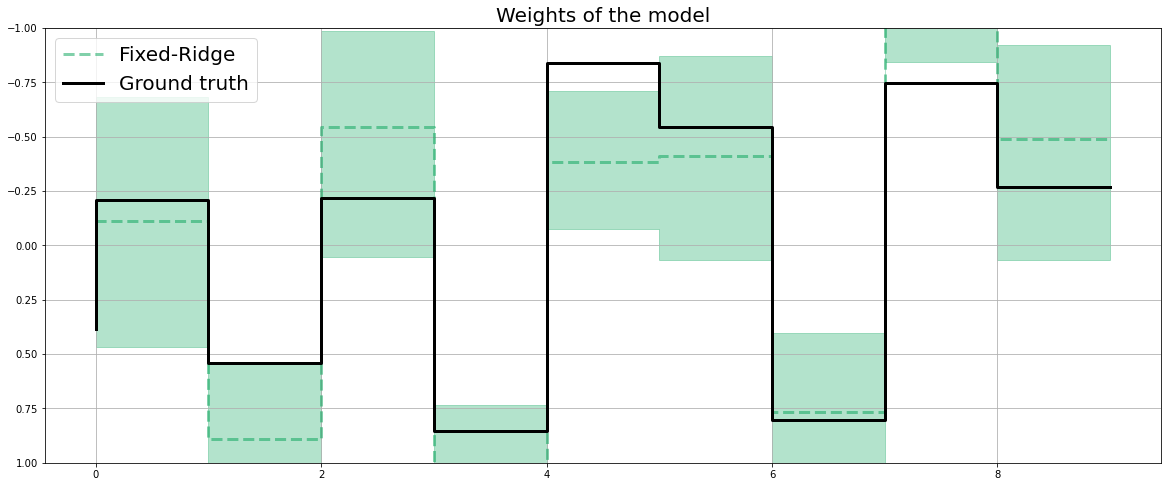

Fixed Ridge Penalty¶

[8]:

%%time

dlt_fridge = DLT(

response_col=response_col,

date_col=dt_col,

regressor_col=x_cols,

seed=SEED,

# this is default

regression_penalty='fixed_ridge',

# fixing the smoothing parameters to learn regression coefficients more effectively

level_sm_input=0.01,

slope_sm_input=0.01,

num_warmup=4000,

)

dlt_fridge.fit(df=df)

INFO:orbit:Sampling (PyStan) with chains: 4, cores: 8, temperature: 1.000, warmups (per chain): 1000 and samples(per chain): 25.

WARNING:pystan:n_eff / iter below 0.001 indicates that the effective sample size has likely been overestimated

WARNING:pystan:Rhat above 1.1 or below 0.9 indicates that the chains very likely have not mixed

CPU times: user 46.3 ms, sys: 43 ms, total: 89.3 ms

Wall time: 1.4 s

[8]:

<orbit.forecaster.full_bayes.FullBayesianForecaster at 0x177f1f610>

[9]:

coef_fridge = np.quantile(dlt_fridge._posterior_samples['beta'], q=[0.05, 0.5, 0.95], axis=0 )

lw=3

idx = np.arange(NUM_OF_REGRESSORS)

plt.figure(figsize=(20, 8))

plt.title("Weights of the model", fontsize=20)

plt.plot(idx, coef_fridge[1], color=OrbitPalette.GREEN.value, linewidth=lw, drawstyle='steps', label='Fixed-Ridge', alpha=0.5, linestyle='--')

plt.fill_between(idx, coef_fridge[0], coef_fridge[2], step='pre', alpha=0.3, color=OrbitPalette.GREEN.value)

plt.plot(coefs, color="black", linewidth=lw, drawstyle='steps', label="Ground truth")

plt.ylim(1, -1)

plt.legend(prop={'size': 20})

plt.grid()

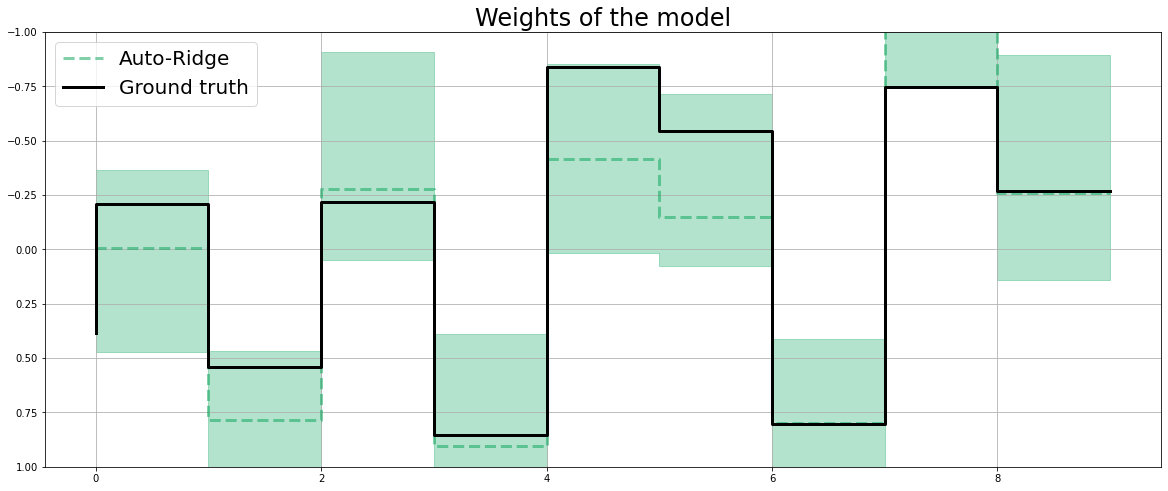

Auto-Ridge Penalty¶

Users can also set the regression_penalty to be auto-ridge in case users are not sure what to set for the regressor_sigma_prior.

Instead of using fixed scale in the coefficients prior, a prior can be assigned to them, i.e.

This can be done by setting regression_penalty="auto_ridge" with the argument auto_ridge_scale (default of 0.5) set the prior \(\alpha\). A higher adapt_delta is recommend to reduce divergence. Check here for details of adapt_delta.

[10]:

%%time

dlt_auto_ridge = DLT(

response_col=response_col,

date_col=dt_col,

regressor_col=x_cols,

seed=SEED,

# this is default

regression_penalty='auto_ridge',

# fixing the smoothing parameters to learn regression coefficients more effectively

level_sm_input=0.01,

slope_sm_input=0.01,

num_warmup=4000,

# reduce divergence

stan_mcmc_control={'adapt_delta':0.9},

)

dlt_auto_ridge.fit(df=df)

INFO:orbit:Sampling (PyStan) with chains: 4, cores: 8, temperature: 1.000, warmups (per chain): 1000 and samples(per chain): 25.

WARNING:pystan:n_eff / iter below 0.001 indicates that the effective sample size has likely been overestimated

WARNING:pystan:Rhat above 1.1 or below 0.9 indicates that the chains very likely have not mixed

CPU times: user 210 ms, sys: 84.7 ms, total: 295 ms

Wall time: 2.53 s

[10]:

<orbit.forecaster.full_bayes.FullBayesianForecaster at 0x178041f70>

[11]:

coef_auto_ridge = np.quantile(dlt_auto_ridge._posterior_samples['beta'], q=[0.05, 0.5, 0.95], axis=0 )

lw=3

idx = np.arange(NUM_OF_REGRESSORS)

plt.figure(figsize=(20, 8))

plt.title("Weights of the model", fontsize=24)

plt.plot(idx, coef_auto_ridge[1], color=OrbitPalette.GREEN.value, linewidth=lw, drawstyle='steps', label='Auto-Ridge', alpha=0.5, linestyle='--')

plt.fill_between(idx, coef_auto_ridge[0], coef_auto_ridge[2], step='pre', alpha=0.3, color=OrbitPalette.GREEN.value)

plt.plot(coefs, color="black", linewidth=lw, drawstyle='steps', label="Ground truth")

plt.ylim(1, -1)

plt.legend(prop={'size': 20})

plt.grid();

[12]:

print('Fixed Ridge MSE:{:.3f}\nAuto Ridge MSE:{:.3f}'.format(

mse(coef_fridge[1], coefs), mse(coef_auto_ridge[1], coefs)

))

Fixed Ridge MSE:0.103

Auto Ridge MSE:0.075

Sparse Regrssion¶

In reality, users usually faces a more challenging problem with a much higher \(P\) to \(N\) ratio with a sparsity specified by the parameter relevance=0.5 under the simulation process.

[13]:

NUM_OF_REGRESSORS = 50

SERIES_LEN = 50

SEED = 20210101

COEFS = np.random.default_rng(SEED).uniform(0.3, 0.5, NUM_OF_REGRESSORS)

SIGNS = np.random.default_rng(SEED).choice([1, -1], NUM_OF_REGRESSORS)

# to mimic a either zero or relative observable coefficients

COEFS = COEFS * SIGNS

trend = make_trend(SERIES_LEN, rw_loc=0.01, rw_scale=0.1)

x, regression, coefs = make_regression(series_len=SERIES_LEN, coefs=COEFS, relevance=0.5)

print(regression.shape, x.shape)

(50,) (50, 50)

[14]:

# generated sparsed coefficients

coefs

[14]:

array([ 0. , 0. , -0.45404565, 0.37813559, 0. ,

0. , 0. , 0.48036792, -0.32535635, -0.37337302,

-0.42474576, 0. , -0.37000755, 0.44887456, 0.47082836,

0. , 0.32678039, 0.37436121, 0.38932392, 0.40216056,

0. , 0. , -0.3076828 , -0.35036047, 0. ,

0. , 0. , 0. , 0. , 0. ,

-0.45838674, 0.3171478 , 0. , 0. , 0. ,

0. , 0. , 0.41599814, 0. , -0.30964341,

-0.42072894, 0.36255583, 0. , -0.39326337, 0.44455655,

0. , 0. , 0.30064161, -0.46083203, 0. ])

[15]:

# combine trend and the regression

y = trend + regression

[16]:

x_cols = [f"x{x}" for x in range(1, NUM_OF_REGRESSORS + 1)]

response_col = "y"

dt_col = "date"

obs_matrix = np.concatenate([y.reshape(-1, 1), x], axis=1)

# make a data frame for orbit inputs

df = pd.DataFrame(obs_matrix, columns=[response_col] + x_cols)

# make some dummy date stamp

dt = pd.date_range(start='2016-01-04', periods=SERIES_LEN, freq="1W")

df['date'] = dt

df.shape

[16]:

(50, 52)

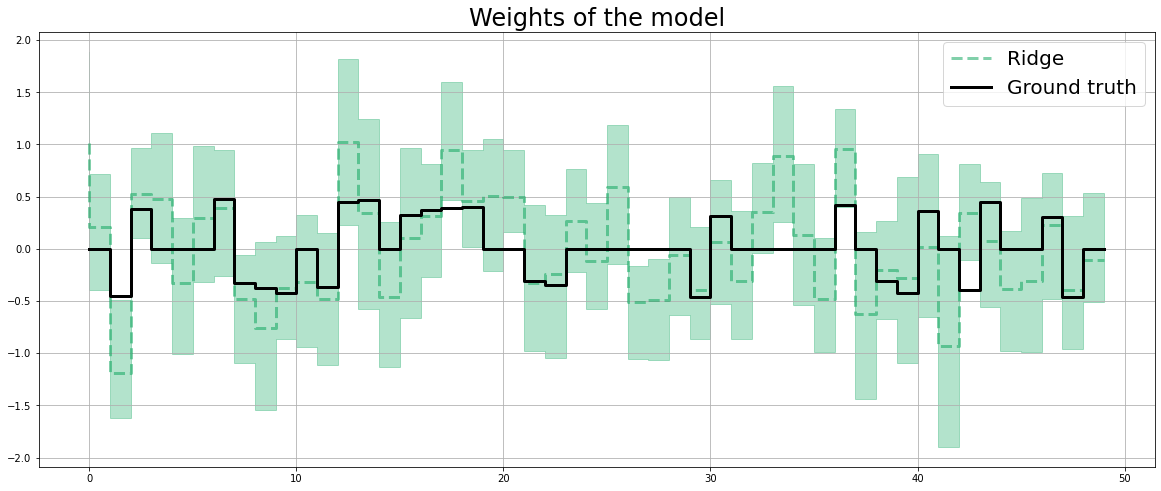

Fixed Ridge Penalty¶

[17]:

dlt_fridge = DLT(

response_col=response_col,

date_col=dt_col,

regressor_col=x_cols,

seed=SEED,

level_sm_input=0.01,

slope_sm_input=0.01,

num_warmup=8000,

)

dlt_fridge.fit(df=df)

INFO:orbit:Sampling (PyStan) with chains: 4, cores: 8, temperature: 1.000, warmups (per chain): 2000 and samples(per chain): 25.

WARNING:pystan:n_eff / iter below 0.001 indicates that the effective sample size has likely been overestimated

WARNING:pystan:Rhat above 1.1 or below 0.9 indicates that the chains very likely have not mixed

[17]:

<orbit.forecaster.full_bayes.FullBayesianForecaster at 0x1783c0340>

[18]:

coef_fridge = np.quantile(dlt_fridge._posterior_samples['beta'], q=[0.05, 0.5, 0.95], axis=0 )

lw=3

idx = np.arange(NUM_OF_REGRESSORS)

plt.figure(figsize=(20, 8))

plt.title("Weights of the model", fontsize=24)

plt.plot(coef_fridge[1], color=OrbitPalette.GREEN.value, linewidth=lw, drawstyle='steps', label="Ridge", alpha=0.5, linestyle='--')

plt.fill_between(idx, coef_fridge[0], coef_fridge[2], step='pre', alpha=0.3, color=OrbitPalette.GREEN.value)

plt.plot(coefs, color="black", linewidth=lw, drawstyle='steps', label="Ground truth")

plt.legend(prop={'size': 20})

plt.grid();

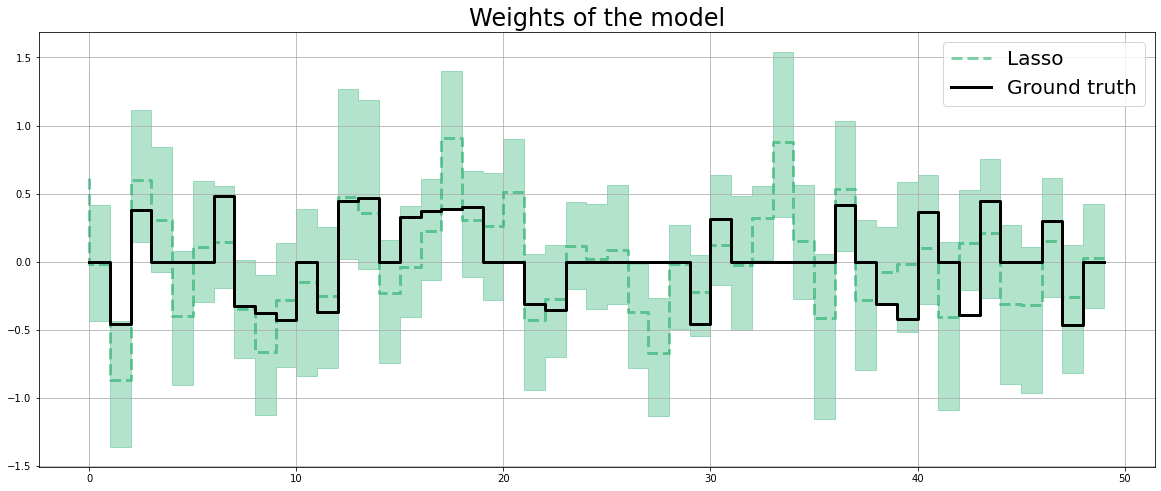

LASSO Penalty¶

In high \(P\) to \(N\) problems, LASS0 penalty usually shines compared to Ridge penalty.

[19]:

dlt_lasso = DLT(

response_col=response_col,

date_col=dt_col,

regressor_col=x_cols,

seed=SEED,

regression_penalty='lasso',

level_sm_input=0.01,

slope_sm_input=0.01,

num_warmup=8000,

)

dlt_lasso.fit(df=df)

INFO:orbit:Sampling (PyStan) with chains: 4, cores: 8, temperature: 1.000, warmups (per chain): 2000 and samples(per chain): 25.

WARNING:pystan:n_eff / iter below 0.001 indicates that the effective sample size has likely been overestimated

WARNING:pystan:Rhat above 1.1 or below 0.9 indicates that the chains very likely have not mixed

[19]:

<orbit.forecaster.full_bayes.FullBayesianForecaster at 0x17a5489d0>

[20]:

coef_lasso = np.quantile(dlt_lasso._posterior_samples['beta'], q=[0.05, 0.5, 0.95], axis=0 )

lw=3

idx = np.arange(NUM_OF_REGRESSORS)

plt.figure(figsize=(20, 8))

plt.title("Weights of the model", fontsize=24)

plt.plot(coef_lasso[1], color=OrbitPalette.GREEN.value, linewidth=lw, drawstyle='steps', label="Lasso", alpha=0.5, linestyle='--')

plt.fill_between(idx, coef_lasso[0], coef_lasso[2], step='pre', alpha=0.3, color=OrbitPalette.GREEN.value)

plt.plot(coefs, color="black", linewidth=lw, drawstyle='steps', label="Ground truth")

plt.legend(prop={'size': 20})

plt.grid();

[21]:

print('Fixed Ridge MSE:{:.3f}\nLASSO MSE:{:.3f}'.format(

mse(coef_fridge[1], coefs), mse(coef_lasso[1], coefs)

))

Fixed Ridge MSE:0.174

LASSO MSE:0.098

Summary¶

This notebook covers a few choices of penalty in regression regularization. A lasso and auto-ridge can be considered in highly sparse data.