Kernel-based Time-varying Regression - Part IV¶

This is final tutorial on KTR. It continues from Part III with additional details on some of the advanced arguments. For other details on KTR see either the previous three tutorials or the original paper Ng, Wang and Dai (2021).

In Part IV covers advance inputs for regression including

regressors signs

time-point coefficients priors

[1]:

import pandas as pd

import numpy as np

from math import pi

import matplotlib.pyplot as plt

import orbit

from orbit.models import KTR

from orbit.diagnostics.plot import plot_predicted_components

from orbit.utils.plot import get_orbit_style

from orbit.utils.kernels import gauss_kernel

from orbit.constants.palette import OrbitPalette

%matplotlib inline

pd.set_option('display.float_format', lambda x: '%.5f' % x)

orbit_style = get_orbit_style()

plt.style.use(orbit_style);

[2]:

print(orbit.__version__)

1.1.4.6

Data¶

To demonstrate the effect of specifying regressors coefficients sign, it is helpful to modify the data simulation code from part II. The simulation is altered to impose strictly positive regression coefficients.

In the KTR model below, the coefficient curves are approximated with Gaussian kernels having positive values of knots. The levels are also included in the process with vector of ones as the covariates.

The parameters used to setup the data simulation are:

n: number of time stepsp: number of predictors

[3]:

np.random.seed(2021)

n = 300

p = 2

tp = np.arange(1, 301) / 300

knot_tp = np.array([1, 100, 200, 300]) / 300

beta_knot = np.array(

[[1.0, 0.1, 0.15],

[3.0, 0.01, 0.05],

[3.0, 0.01, 0.05],

[2.0, 0.05, 0.02]]

)

gk = gauss_kernel(tp, knot_tp, rho=0.2)

beta = np.matmul(gk, beta_knot)

covar_lev = np.ones((n, 1))

covar = np.concatenate((covar_lev, np.random.normal(0, 1.0, (n, p))), axis=1)\

# observation with noise

y = (covar * beta).sum(-1) + np.random.normal(0, 0.1, n)

regressor_col = ['x{}'.format(pp) for pp in range(1, p+1)]

data = pd.DataFrame(covar[:,1:], columns=regressor_col)

data['y'] = y

data['date'] = pd.date_range(start='1/1/2018', periods=len(y))

data = data[['date', 'y'] + regressor_col]

beta_col = ['beta{}'.format(pp) for pp in range(1, p+1)]

beta_data = pd.DataFrame(beta[:,1:], columns=beta_col)

data = pd.concat([data, beta_data], axis=1)

[4]:

data.tail(10)

[4]:

| date | y | x1 | x2 | beta1 | beta2 | |

|---|---|---|---|---|---|---|

| 290 | 2018-10-18 | 2.15947 | -0.62762 | 0.17840 | 0.04015 | 0.02739 |

| 291 | 2018-10-19 | 2.25871 | -0.92975 | 0.81415 | 0.04036 | 0.02723 |

| 292 | 2018-10-20 | 2.18356 | 0.82438 | -0.92705 | 0.04057 | 0.02707 |

| 293 | 2018-10-21 | 2.26948 | 1.57181 | -0.78098 | 0.04077 | 0.02692 |

| 294 | 2018-10-22 | 2.26375 | -1.07504 | -0.86523 | 0.04097 | 0.02677 |

| 295 | 2018-10-23 | 2.21349 | 0.24637 | -0.98398 | 0.04117 | 0.02663 |

| 296 | 2018-10-24 | 2.13297 | -0.58716 | 0.59911 | 0.04136 | 0.02648 |

| 297 | 2018-10-25 | 2.00949 | -2.01610 | 0.08618 | 0.04155 | 0.02634 |

| 298 | 2018-10-26 | 2.14302 | 0.33863 | -0.37912 | 0.04173 | 0.02620 |

| 299 | 2018-10-27 | 2.10795 | -0.96160 | -0.42383 | 0.04192 | 0.02606 |

Just like previous tutorials in regression, some additional args are used to describe the regressors and the scale parameters for the knots.

[5]:

ktr = KTR(

response_col='y',

date_col='date',

regressor_col=regressor_col,

regressor_init_knot_scale=[0.1] * p,

regressor_knot_scale=[0.1] * p,

prediction_percentiles=[2.5, 97.5],

seed=2021,

estimator='pyro-svi',

)

ktr.fit(df=data)

2024-03-19 23:39:37 - orbit - INFO - Optimizing (CmdStanPy) with algorithm: LBFGS.

2024-03-19 23:39:37 - orbit - INFO - Using SVI (Pyro) with steps: 301, samples: 100, learning rate: 0.1, learning_rate_total_decay: 1.0 and particles: 100.

/Users/towinazure/opt/miniconda3/envs/orbit311/lib/python3.11/site-packages/torch/__init__.py:696: UserWarning: torch.set_default_tensor_type() is deprecated as of PyTorch 2.1, please use torch.set_default_dtype() and torch.set_default_device() as alternatives. (Triggered internally at /Users/runner/work/pytorch/pytorch/pytorch/torch/csrc/tensor/python_tensor.cpp:453.)

_C._set_default_tensor_type(t)

2024-03-19 23:39:38 - orbit - INFO - step 0 loss = -3.5592, scale = 0.085307

INFO:orbit:step 0 loss = -3.5592, scale = 0.085307

2024-03-19 23:39:39 - orbit - INFO - step 100 loss = -228.48, scale = 0.036575

INFO:orbit:step 100 loss = -228.48, scale = 0.036575

2024-03-19 23:39:40 - orbit - INFO - step 200 loss = -230.1, scale = 0.038104

INFO:orbit:step 200 loss = -230.1, scale = 0.038104

2024-03-19 23:39:41 - orbit - INFO - step 300 loss = -229.33, scale = 0.037629

INFO:orbit:step 300 loss = -229.33, scale = 0.037629

[5]:

<orbit.forecaster.svi.SVIForecaster at 0x2a836ad90>

Visualization of Regression Coefficient Curves¶

The get_regression_coefs argument is used to extract coefficients with intervals by supplying the argument include_ci=True.

[6]:

coef_mid, coef_lower, coef_upper = ktr.get_regression_coefs(include_ci=True)

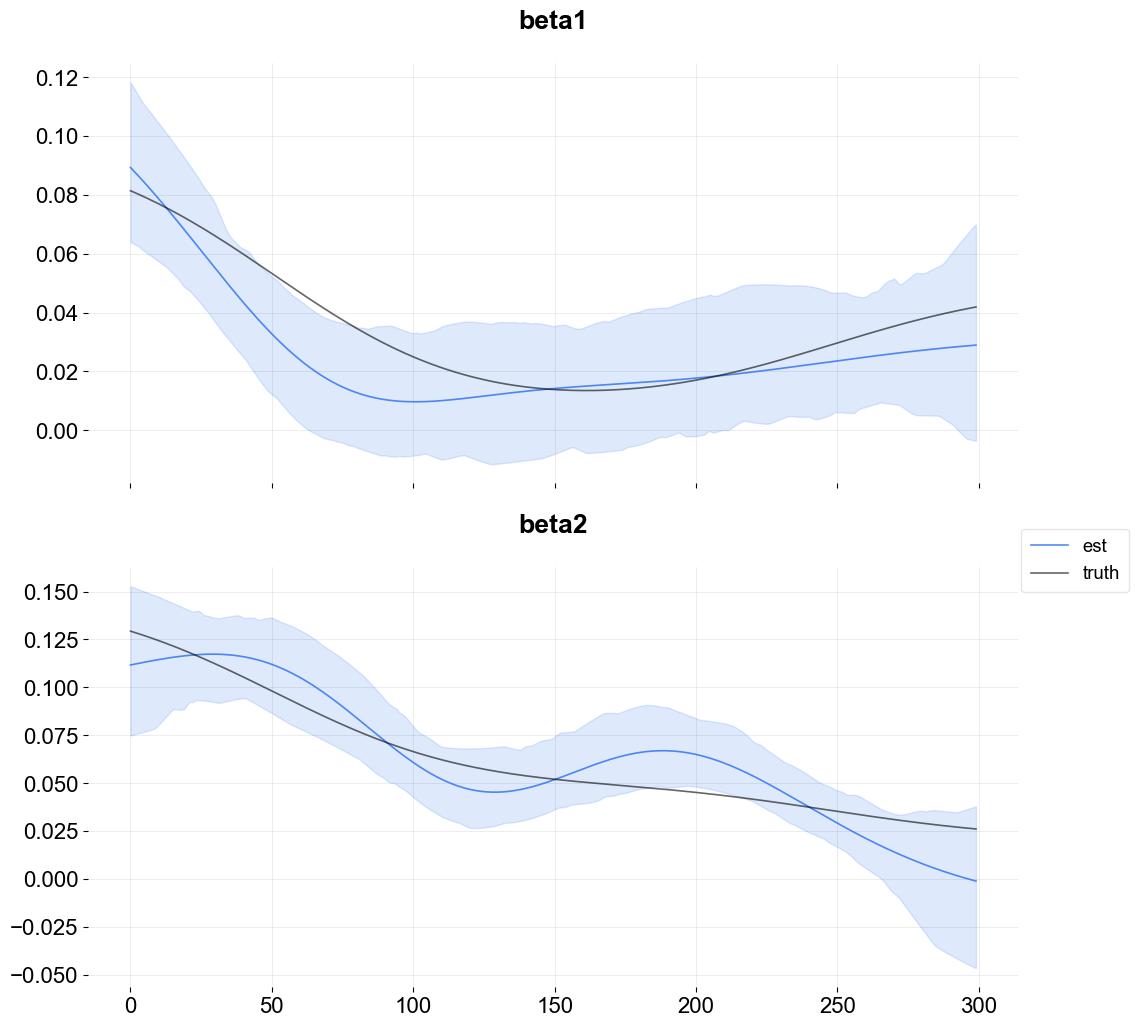

The next figure shows the overlay of the estimate on the true coefficients. Since the lower bound is below zero some of the coefficient posterior samples are negative.

[7]:

fig, axes = plt.subplots(p, 1, figsize=(12, 12), sharex=True)

x = np.arange(coef_mid.shape[0])

for idx in range(p):

axes[idx].plot(x, coef_mid['x{}'.format(idx + 1)], label='est' if idx == 0 else "", alpha=0.8, color=OrbitPalette.BLUE.value)

axes[idx].fill_between(x, coef_lower['x{}'.format(idx + 1)], coef_upper['x{}'.format(idx + 1)], alpha=0.15, color=OrbitPalette.BLUE.value)

axes[idx].plot(x, data['beta{}'.format(idx + 1)], label='truth' if idx == 0 else "", alpha=0.6, color = OrbitPalette.BLACK.value)

axes[idx].set_title('beta{}'.format(idx + 1))

fig.legend(bbox_to_anchor = (1,0.5));

Regressor Sign¶

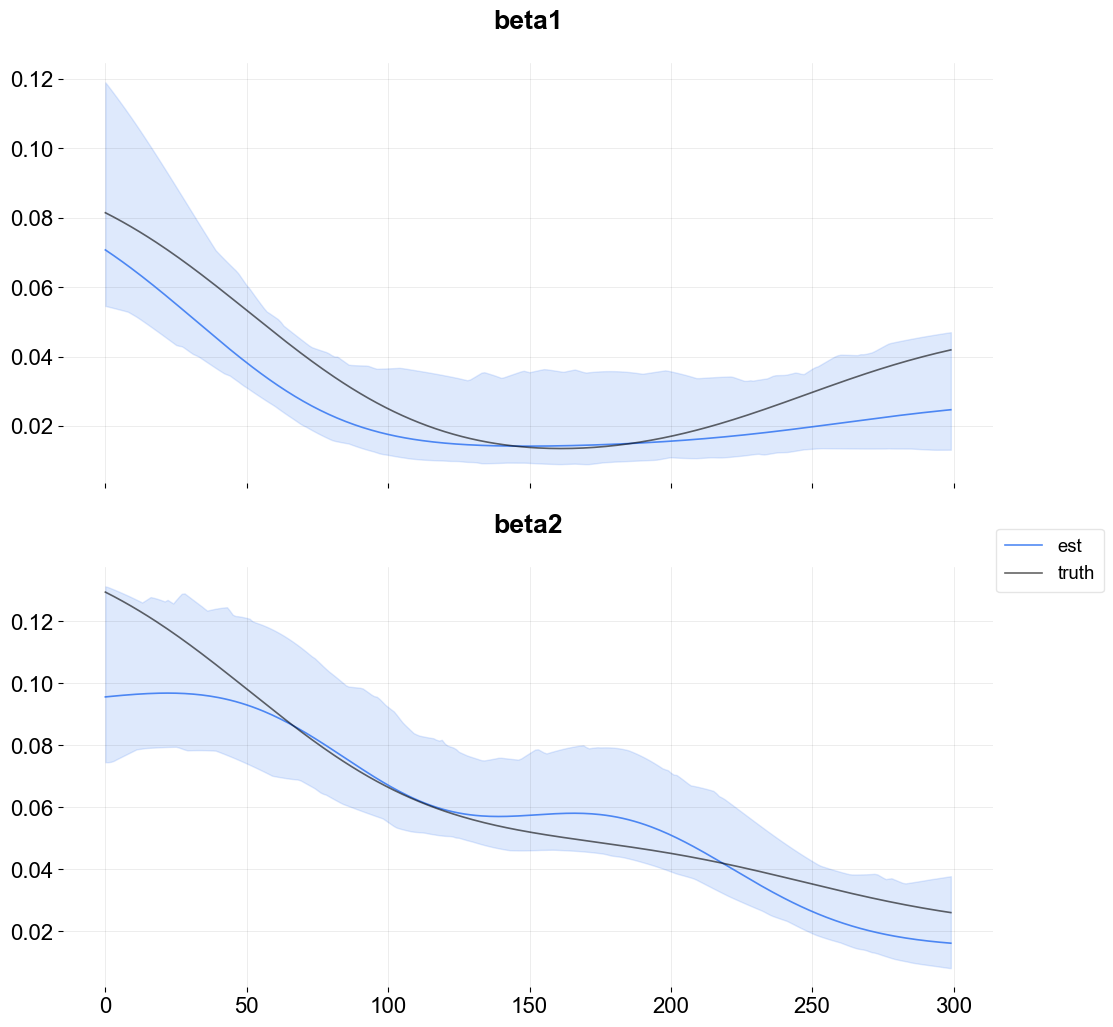

Strictly positive coefficients can be imposed by using the regressor_sign arg. It can have values “=”, “-”, or “+” which denote no restriction, strictly negative, strictly positive. Note that it is possible to have a mixture by providing a list of strings one for each regressor.

[8]:

ktr = KTR(

response_col='y',

date_col='date',

regressor_col=regressor_col,

regressor_init_knot_scale=[0.1] * p,

regressor_knot_scale=[0.1] * p,

regressor_sign=['+'] * p,

prediction_percentiles=[2.5, 97.5],

seed=2021,

estimator='pyro-svi',

)

ktr.fit(df=data)

2024-03-19 23:39:41 - orbit - INFO - Optimizing (CmdStanPy) with algorithm: LBFGS.

INFO:orbit:Optimizing (CmdStanPy) with algorithm: LBFGS.

2024-03-19 23:39:41 - orbit - INFO - Using SVI (Pyro) with steps: 301, samples: 100, learning rate: 0.1, learning_rate_total_decay: 1.0 and particles: 100.

INFO:orbit:Using SVI (Pyro) with steps: 301, samples: 100, learning rate: 0.1, learning_rate_total_decay: 1.0 and particles: 100.

2024-03-19 23:39:41 - orbit - INFO - step 0 loss = 9.7371, scale = 0.10482

INFO:orbit:step 0 loss = 9.7371, scale = 0.10482

2024-03-19 23:39:43 - orbit - INFO - step 100 loss = -231.22, scale = 0.41649

INFO:orbit:step 100 loss = -231.22, scale = 0.41649

2024-03-19 23:39:45 - orbit - INFO - step 200 loss = -230.94, scale = 0.42589

INFO:orbit:step 200 loss = -230.94, scale = 0.42589

2024-03-19 23:39:46 - orbit - INFO - step 300 loss = -230.26, scale = 0.41749

INFO:orbit:step 300 loss = -230.26, scale = 0.41749

[8]:

<orbit.forecaster.svi.SVIForecaster at 0x2b1d43810>

[9]:

coef_mid, coef_lower, coef_upper = ktr.get_regression_coefs(include_ci=True)

[10]:

fig, axes = plt.subplots(p, 1, figsize=(12, 12), sharex=True)

x = np.arange(coef_mid.shape[0])

for idx in range(p):

axes[idx].plot(x, coef_mid['x{}'.format(idx + 1)], label='est' if idx == 0 else "", alpha=0.8, color=OrbitPalette.BLUE.value)

axes[idx].fill_between(x, coef_lower['x{}'.format(idx + 1)], coef_upper['x{}'.format(idx + 1)], alpha=0.15, color=OrbitPalette.BLUE.value)

axes[idx].plot(x, data['beta{}'.format(idx + 1)], label='truth' if idx == 0 else "", alpha=0.6, color = OrbitPalette.BLACK.value)

axes[idx].set_title('beta{}'.format(idx + 1))

fig.legend(bbox_to_anchor = (1,0.5));

Observe the curves lie in the positive range with a slightly improved fit relative to the last model.

To conclude, it is useful to have a strictly positive range of regression coefficients if that range is known a priori. KTR allows these priors to be specified. For regression scenarios where there is no a priori knowledge of the coefficient sign it is recommended to use the default which contains both sides of the range.

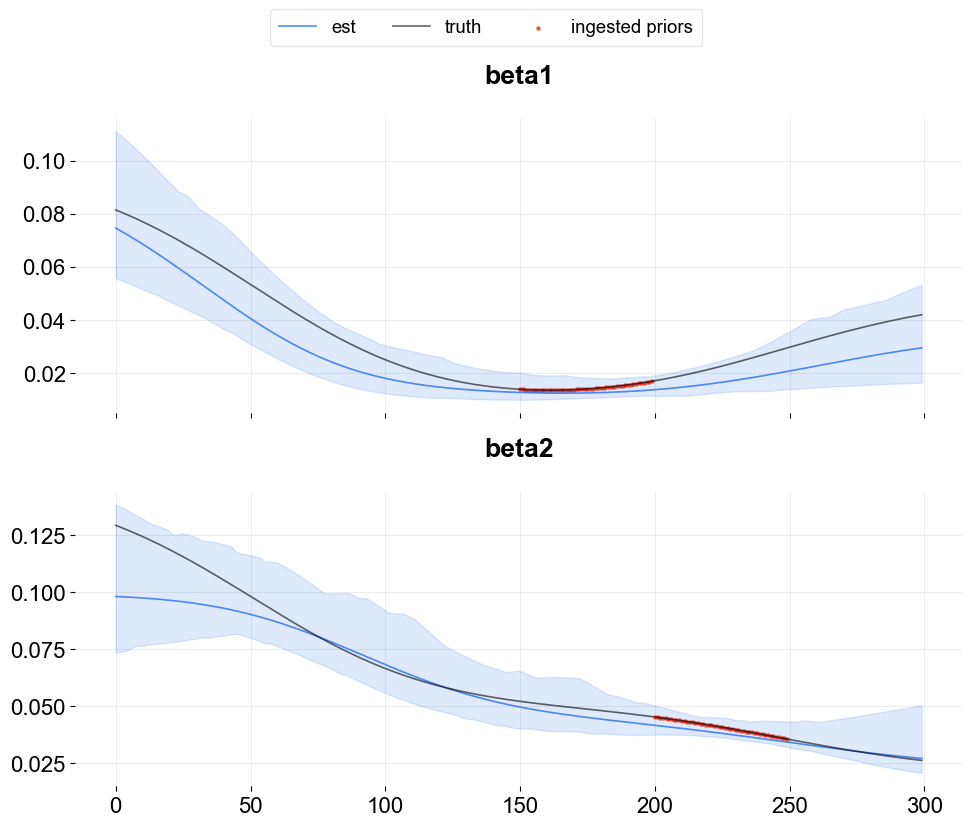

Time-point coefficient priors¶

Users can incorporate coefficient priors for any regressor and any time period. This feature is quite useful when users have some prior knowledge or beliefs on regressor coefficients. For example, if an A/B test is conducted for a certain regressor over a specific time range, then users can ingest the priors derived from such A/B test.

This can be done by supplying a list of dictionaries via coef_prior_list. Each dict in the list should have keys as name, prior_start_tp_idx (inclusive), prior_end_tp_idx (not inclusive), prior_mean, prior_sd, and prior_regressor_col.

Below is an illustrative example by using the simulated data above.

[11]:

from copy import deepcopy

[12]:

prior_duration = 50

coef_list_dict = []

prior_idx=[

np.arange(150, 150 + prior_duration),

np.arange(200, 200 + prior_duration),

]

regressor_idx = range(1, p + 1)

plot_dict = {}

for i in regressor_idx:

plot_dict[i] = {'idx': [], 'val': []}

[13]:

for idx, idx2, regressor in zip(prior_idx, regressor_idx, regressor_col):

prior_dict = {}

prior_dict['name'] = f'prior_{regressor}'

prior_dict['prior_start_tp_idx'] = idx[0]

prior_dict['prior_end_tp_idx'] = idx[-1] + 1

prior_dict['prior_mean'] = beta[idx, idx2]

prior_dict['prior_sd'] = [0.1] * len(idx)

prior_dict['prior_regressor_col'] = [regressor] * len(idx)

plot_dict[idx2]['idx'].extend(idx)

plot_dict[idx2]['val'].extend(beta[idx, idx2])

coef_list_dict.append(deepcopy(prior_dict))

[14]:

ktr = KTR(

response_col='y',

date_col='date',

regressor_col=regressor_col,

regressor_init_knot_scale=[0.1] * p,

regressor_knot_scale=[0.1] * p,

regressor_sign=['+'] * p,

coef_prior_list = coef_list_dict,

prediction_percentiles=[2.5, 97.5],

seed=2021,

estimator='pyro-svi',

)

ktr.fit(df=data)

2024-03-19 23:39:47 - orbit - INFO - Optimizing (CmdStanPy) with algorithm: LBFGS.

INFO:orbit:Optimizing (CmdStanPy) with algorithm: LBFGS.

2024-03-19 23:39:47 - orbit - INFO - Using SVI (Pyro) with steps: 301, samples: 100, learning rate: 0.1, learning_rate_total_decay: 1.0 and particles: 100.

INFO:orbit:Using SVI (Pyro) with steps: 301, samples: 100, learning rate: 0.1, learning_rate_total_decay: 1.0 and particles: 100.

2024-03-19 23:39:47 - orbit - INFO - step 0 loss = -5741.9, scale = 0.094521

INFO:orbit:step 0 loss = -5741.9, scale = 0.094521

2024-03-19 23:39:52 - orbit - INFO - step 100 loss = -7140.3, scale = 0.31416

INFO:orbit:step 100 loss = -7140.3, scale = 0.31416

2024-03-19 23:39:55 - orbit - INFO - step 200 loss = -7139.1, scale = 0.31712

INFO:orbit:step 200 loss = -7139.1, scale = 0.31712

2024-03-19 23:39:57 - orbit - INFO - step 300 loss = -7139.5, scale = 0.33039

INFO:orbit:step 300 loss = -7139.5, scale = 0.33039

[14]:

<orbit.forecaster.svi.SVIForecaster at 0x2b1eb5f10>

[15]:

coef_mid, coef_lower, coef_upper = ktr.get_regression_coefs(include_ci=True)

[16]:

fig, axes = plt.subplots(p, 1, figsize=(10, 8), sharex=True)

x = np.arange(coef_mid.shape[0])

for idx in range(p):

axes[idx].plot(x, coef_mid['x{}'.format(idx + 1)], label='est', alpha=0.8, color=OrbitPalette.BLUE.value)

axes[idx].fill_between(x, coef_lower['x{}'.format(idx + 1)], coef_upper['x{}'.format(idx + 1)], alpha=0.15, color=OrbitPalette.BLUE.value)

axes[idx].plot(x, data['beta{}'.format(idx + 1)], label='truth', alpha=0.6, color = OrbitPalette.BLACK.value)

axes[idx].set_title('beta{}'.format(idx + 1))

axes[idx].scatter(plot_dict[idx + 1]['idx'], plot_dict[idx + 1]['val'],

s=5, color=OrbitPalette.RED.value, alpha=.6, label='ingested priors')

handles, labels = axes[0].get_legend_handles_labels()

fig.legend(handles, labels, loc='upper center', ncol=3, bbox_to_anchor=(.5, 1.05))

plt.tight_layout()

As seen above, for the ingested prior time window, the estimation is aligned better with the truth and the resulting confidence interval also becomes narrower compared to other periods.

References¶

Ng, Wang and Dai (2021). Bayesian Time Varying Coefficient Model with Applications to Marketing Mix Modeling, arXiv preprint arXiv:2106.03322